Hi All.

A quick post to summarize past week's movement on FKLI & FCPO.

FKLI (Daily)

Past week close below 1,700 for consecutive two days appeared to be a false alarm. Price quickly reverse after it & continued upward, overcame 1,710 resistance & subsequently made a new high at 1,720.5.

Today saw an inside bar formed, we shall see which direction it will breakout to tomorrow.

In the mean time, I'll watch the uptrend line extending from previous significant low of 1,585 closely, as its violation may bring about a furious plunge, as those seen in Nov'12 & Jan'13.

|

| FKLI - Look Toppish, Watch for Violation of Up-TL from 1,585 low (April 29) |

FKLI (Monthly, Long-term view)

FKLI has been stuck sideways within the 1,600-1,700 range for 7-8mths since early Sept'12.

I put up a 10yr chart on our index futures & marked out major trends defining the past decade of FKLI history.

Notice how congestion areas (shaded in magenta) near significant tops (then all-time highs) has shown tendency of signalling prominent trend change ahead.

Also, notice that the climb from Sept'11 low of 1,295 to current height above 1,700, it forms a rising wedge pattern.

In fact, the whole post-subprime bull run, from 800 low to current, is itself a huge long-term rising wedge, where the top of it passes through subsequent all-time highs of 1,535 (yr 2008), 1,580 & 1,597 (yr 2011), and the latest 1,705 & 1,720 (2013).

Wedge patterns, or ending-diagonals as regarded by Elliotticians, are often found at end of motive cycle (Wave 5 or Wave C; in upward & downward moves), especially those where the Wave3 has risen too fast & too far (i.e. extended waves).

We now have a coiled-Ending diagonal (the best way to describe it that I can think of...lol), one within another, on two different degrees (Cycle & Primary) of the Elliott Wave hierarchy.

In plain terms, we are near end of the post-subprime bull run, which at the same time, represent the end of a Super-Bull market which could well backdate to the post-Asian-financial-crisis low of 265 (Sept'98).

+-+Congestion+near+top+before+major+trend+change.png) |

| FKLI - Coiled-ending diagonals?! Potential end to post-'08 bull run (April 29) |

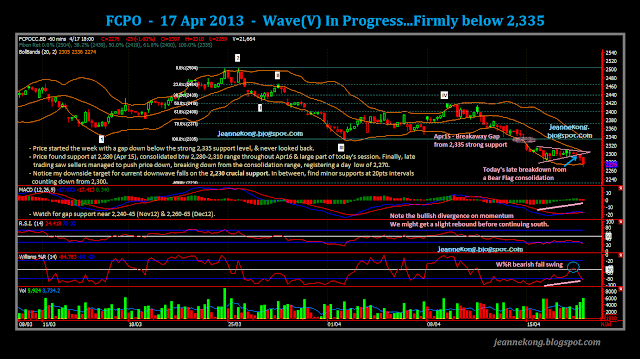

FCPO (Daily)

From previous low of 2,250, price rebounded strongly back to 2,305-2,315 area. Later, it broke above the 2,315 resistance & rise swiftly to cover the 2,325-2,335 gap (Apr15).

However, Bulls hesitated at 2,334 high, Bears thus confidently stepped in & press price back down to 2,315.

Today, Bears took it another level down to below 2,300 & 2,280 support, touch intraday low of 2,260, below short-coverings brought price back up to close at 2,277. A long red formed on the daily.

The 2,250-60 support band may continue to hold, as a pin bar formed on the 2,260 level as sellers cover their positions in last-minutes of trading.

Shall it fails to hold, we shall see accelerate drop to find the major support band at 2,220-30, eventually.

|

| FCPO - Rebound stopped below 2,335 resistance level (April 29) |

>>>

I shall update on GOLD in my next post, within this week.

In the mean time, I'll come back to FKLI & FCPO after 050513 GE13 Polling Day.

Drive safe, as you head home to vote.

Needless to say, we know which coalition we are voting for...If you're still not sure (for some real weird reason :p), just take a tour around FB & you'll no doubt be darn clear where you'll 'X' on that ballot paper on May05.

See ya'all after The Change!

Ini Kalilah!! :)

.png)

.png)

.JPG)

Jeanne, what's trade style you more on? long/short term position or intraday? you must be able to control the emotional and psychological problems before as full time trader, any advice for those want to become full time trader?

Some guys peeping here want to know , they shy to ask, hahahahhaha

I hold swing positions on FKLI (basic income), & day trade CPO (extra pocket money).

This is my current style. When I have grow my account enough as planned, I will change to another 'combo'...lol

The truth is, I was kinda 'forced' to quit my day job earlier than expected (long & sad story), came in short of my initially planned starting capital.

Turned full-time anyway, coz I believe in forcing myself out of comfort zone to achieve higher goals, also I believe I have found my direction in the trading business.

Remember this, traders are not God, we are still humans, i.e. we can get emotional.

I got tricked by the 'news' during the April03 dissolution roller-coaster too. Technical says buy, but I'm too 'convinced' that its gonna be a winner to short on dissolution announcement.

The main takeaway is:

- Learn, Experience, come out with ur own trade setup that can give u an 'edge' against the

- When ur setup appears, check the Risk:Reward ratio, if satisfiable, take the trade, DON'T

- Then also, do treat each of ur trades EQUALLY. No one trade MUST BE A WINNER.

I actually started off quite sloppily, big fluctuations in wins n losses. Went all haywire with my psyche.

It's the 'no turning back' factor that keep pushing me to 'evolve' for better, keep learning & adapting, especially the risk management & trading psychology part.

At some point, any traders will have equipped themselves with sufficient TA skills. The only thing that differentiate the consistently-winning from the still-struggling group is TRADE MANAGEMENT & PSYCHOLOGY.